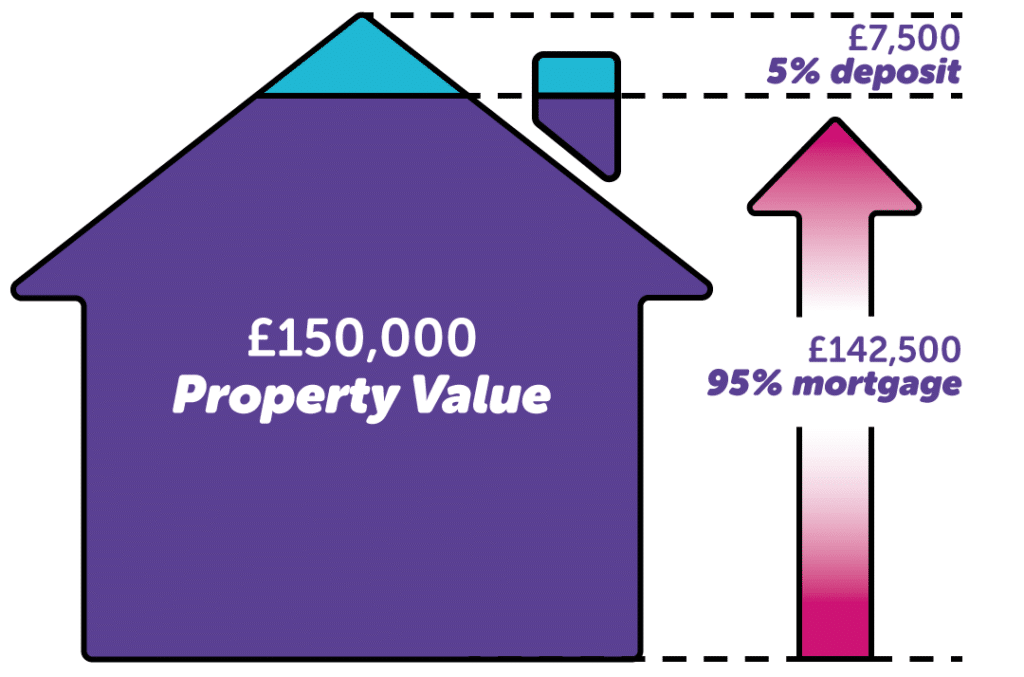

A 95% mortgage is exactly what you’d expect it to be; you are borrowing against 95% of a property’s price, making up the 5% remainder with your own deposit. Here is an example with a property valued at £150,000:

If a property is valued at £150,000 and you manage to receive 95% mortgage offer on the property, you will need to put down your 5% deposit of £7,500 and borrow the remaining £142,500.

95% Mortgage Advice in Birmingham

Following the March 2021 Budget, a new Government home buying scheme was introduced to try and push confidence back into the property market. The scheme is called the “Mortgage Guarantee Scheme for Lenders” and is due to start in April 2021. The scheme allows any home-buyer, whether that be a First Time Buyer or Home Mover, to purchase a property with a 95% mortgage.

Chancellor Rishi Sunak also confirmed that many credible lenders are already backing the scheme which is great news for the mortgage market! The scheme is going to run until December 2022, so you have plenty of time to take advantage of it.

The scheme has certain criteria that you’ll need to match to qualify for it, your Mortgage Advisor in Birmingham will check to see if you meet the requirements of the scheme.

Our Mortgage Broker in Birmingham offers all of our customers a free, no-obligation mortgage consultation. During this process, we will be able to recommend the best mortgage deal based on your individual circumstances.

Can I get a 95% mortgage?

Whether you are a First Time Buyer in Birmingham or planning on Moving Home in Birmingham, you should be able to access a 95% mortgage (depending on your financial and personal situation). Before being accepted for a 95% mortgage, you’ll need a sufficient credit score and be required to prove that you’ll be able to meet your monthly mortgage payments.

Improving Your Credit Score

Having a good credit score will always benefit your mortgage application and chances of being accepted for your 95% mortgage. Ways to improve your credit score consist of paying off any outstanding debts that you owe, closing unused credit accounts, registering on the electoral roll and removing your financial links to others just to name a few.

There are many different ways to improve your credit score, so if you need further credit score Mortgage Advice in Birmingham, don’t hesitate to get in touch with our team. Alternatively, you can take a look at how to improve your credit score article, whichever you feel most comfortable with.

Affordability

You will never be accepted for a mortgage when you cannot afford one, and that’s why lenders need to measure your affordability for a mortgage before accepting you. They will factor in all of the costs of buying a home in Birmingham and assess whether you’ll be able to meet your monthly mortgage payments. This is why you need to provide details of your income and monthly outgoings (usually through bank statements) so that your affordability for a mortgage is backed up.

Can my family help me get a 95% mortgage?

With the rising popularity of gifted deposits, as a Mortgage Broker in Birmingham, it’s not unusual for them to be used for mortgage deposits. A gifted deposit is a sum of money given to an applicant to aid their mortgage application, either by covering the whole of their mortgage deposit or a portion of it. It’s usually parents who give their children a gifted deposit.

Gifted deposits can boost an applicant’s mortgage application. If the applicant already has a portion of their deposit saved up, this extra cash boost could push them above the 5% mark and they may have even more of a chance of being accepted for a mortgage.

You should know that a gifted deposit is strictly a gift and not a loan, lenders won’t accept it otherwise.

How do I choose the right 95% mortgage?

There are lots of different types of mortgages available, so when you are choosing a 95% mortgage, you will want to make sure that you select the best option for your financial and personal situation.

For example, if you choose a 95% Fixed Rate Mortgage, your interest rate will remain the same through your mortgage term, whereas if you choose a 95% Tracker Mortgage, your interest rate will follow the Bank of England base rate.

Alternatively, you could pick a 95% Interest-Only or a 95% Repayment Mortgage. An Interest-Only mortgage will allow you to pay cheaper mortgage payments each month until you need to pay a lump sum at the end of your mortgage term (usually taken out for Buy to Lets). A Repayment Mortgage will combine interest and capital each month into one payment.

It’s important to get yourself a product that is best suited to you. For more information on different types of mortgages, check out our different types of mortgages YouTube playlist.

How can a bigger deposit help with my mortgage?

Usually, the bigger deposit that you can provide and evidence for your mortgage application, the better. It’s better to save up and prepare for your mortgage journey, as lots of costs can come with it! Things that might crop up include higher interest rates, remortgaging difficulties due to less equity and then negative equity.

Having a larger deposit, for example, a deposit of 10-15%, would not only lower your interest rate significantly but would also put more equity in the property and reduce the risk of negative equity as you would be borrowing less against the property in question.

There is good news though, some of these costs can be avoided if you are well prepared. If you are saving for a property, sometimes it may be better to save up just a little more to boost your total deposit.

If you decide to use a Mortgage Broker in Birmingham, we will make sure that you are in the best position possible in order to get accepted for a mortgage. You may not need a larger deposit as other factors in your application may be perfect! You won’t know until you get in touch with our Mortgage Advisors in Birmingham today.

Date Last Edited: February 25, 2025